The recent stock market volatility, soaring inflation, and run-up in home prices have many economists speculating that a recession is on the horizon. This assumption is based on the precursors to prior recessions, many of which we’re experiencing today.

However, analysts who use history as a benchmark for today’s economy are overlooking the fact that the drivers of economic growth have changed over the past 15 years. Namely, the rapid digitization of information has transformed how goods and services are marketed and sold. The rise of Instagram influencers and the ability to leverage low-cost, overseas talent are just two examples of how digitization is impacting economic growth.

In this article, we look at the many ways in which digital transformations may be artificially bolstering the economy, which in turn, influences which indicators may be used to predict future recessions.

What is “digitization”?

Digitization is simply the process of converting information into a digital (e.g., computer-readable) format. Digitization is made possible by what is often referred to as “information and communications technology,” or ICT. ICT is an umbrella term that refers to the integration of telecommunications and computers—including hardware and software, middleware, storage and audiovisuals—that enables users to access, store, transmit, understand and manipulate information.

The impact of digitization is having a profound effect on economic growth and development, not only here in the United States, but all across the world.

4 Ways Digitization Impacts Business Growth

The ways in which digitization impacts the economy continue to evolve. According to a report by the World Economic Forum, as an economy’s digitization increases, its productivity improves. “Some jobs get replaced by technology, and lower-value-added, labor-intensive tasks go overseas to emerging markets where labor is cheaper,” the report notes.

Specifically, digitization is impacting business sectors in four ways:

- Business formation: Digitization is lowering barriers to entry and expanding market reach for enterprises. For example, companies that once relied on local consumers can now leverage social media to expand their reach globally. Service providers can similarly leverage technologies like Zoom and Microsoft Teams to connect with potential clients in different time zones and all around the world. Businesses that would not have otherwise been viable due to limited market reach now have endless opportunities. In many instances, digitization has allowed individuals to test their business models prior to jumping all-in to a new enterprise.

- Go-to-market strategies: Digitization has fundamentally changed how companies build brands, communicate their values, and market their goods and services to customers. Through strategic advertising, businesses can reach new audiences using various online platforms. The resulting explosion of e-commerce has been transformative to how products are sold.

- Production: Digital transformations have also impacted how and where businesses produce various goods and services. For example, many companies now outsource jobs to people living overseas. There could be several reasons for this: in some cases, lower-skilled work can be outsourced to lower-paid workers abroad using platforms like Upwork and Fiverr.

In other cases, there is value in having people work “off-hours” to quickly turn around work for clients located in the U.S. An architect, for example, may receive feedback from a client during the day, and then that feedback can go to designers abroad who can make changes to renderings overnight, allowing the architect to deliver the changes sooner than if they were relying on their local team alone.

In any event, the ability to outsource the production of goods and services has the impact of making today’s businesses more profitable than they would have been in a non-digital era.

- Operations: According to the World Economic Forum study, “digitization has had the greatest impact on the way companies organize and operate to generate competitive advantage.” While a growing number of workers were starting to telecommute pre-Covid, the pandemic accelerated this shift in how and where people work. Today, many companies are saving money by closing physical offices, instead opting to have their teams work remotely. Many back-office roles are being shifted to remote workers in lower-cost regions, which also boosts a company’s bottom line.

Other Profound Economic Shifts Enabled by Digitization

While the impact digitization has had on business growth and development cannot be overlooked, there are other ways in which new technologies are bolstering the economy in ways never seen before. Here are a few examples of how this has taken shape.

- The proliferation of cryptocurrency. “Digital assets” like Bitcoin and Ethereum, have exploded in popularity among users and investors alike. In November 2016, non-state issued digital assets had a market cap of $14 billion. By November 2021, this had skyrocketed to over $3 trillion. Many entrepreneurs reportedly utilize cryptocurrency as a means of accessing international markets and conducting business quickly and with ease. During the last three months of 2020, there were an average of 287,000 confirmed Bitcoin transactions per day worldwide.

On the investment front, cryptocurrency has made some ordinary individuals millionaires (even billionaires) almost overnight. In other instances, people have lost their life’s savings by gambling on an otherwise unregulated, “underground” monetary system.

- The rise of the “creator economy”. The Kardashians are probably the most famous for being “famous” – a skill they have since transformed into actual multi-million-dollar brands. The rapid adoption of social media, from Instagram to Snapchat to TikTok, has created a new era of “social media influencers.” These influencers are the primary driver of the “creator economy,” an economic classification that did not exist a decade ago. The creator economy, which refers to anyone who uses online media to monetize their content online, has helped ordinary individuals earn six-figure (and beyond) incomes by advertising to their followers. The creator economy also includes fashion bloggers, live-streaming games and other people who have gone on to build actual companies around their online “influencer” brands. An estimated 50 million people worldwide consider themselves “creators” according to a recent study—a number that continues to grow at a rapid pace.

- The “Robinhood effect” on the stock market. It used to be that individuals would invest in their traditional, employer-sponsored 401k plan and otherwise, engaged in very little stock trading. Until recently, most platforms (Scottrade, Fidelity and others) would charge a $7-10 fee for each trade, which inherently limited the amount of trading amateurs did. The advent of Robinhood, a platform that offers free trades with no minimum account deposit, radically disrupted the market. Now, curious traders could experiment with nominal dollars and with relative ease.

The widespread utilization of Robinhood among retail investors has allowed these individuals, collectively, to have a dramatic impact on the stock market. The GameStop saga is one of the most notable instances of this: users from the Reddit page “wallstreetbets” gobbled up stock from GameStop, an otherwise floundering video game chain, which sent the price soaring from $20 to over $300 per share. Institutional investors who had bet against the company were forced into a “short squeeze,” where they were forced to repurchase stock as the prices rose.

While a short squeeze is not unheard of, the fact that it was driven by retail investors using new technology and novel trading platforms forced Wall Street to pay attention to retail investors like never before. It became clear that the actions of individuals could, collectively, have a dramatic impact on the stock market. One analysis found that retail investors were indeed a driving force behind the stock market’s second-quarter rally in 2020. The impact on small-cap businesses was especially profound. “Robinhood demand accounted for 20% of the aggregate market capitalization of the [smallest 20% of stocks in the U.S. market], the study found.

In short, the Robinhood effect is expected to cause the stock market to act more erratically than ever before, with small-cap companies expected to face the most volatility.

So, what are we supposed to make of all this? One could argue that these digital transformations are artificially bolstering the economy—therefore making a large-scale recession less likely due to their strengthening of the economy in a way that we have never experienced. Alternatively, one could argue that their fast-paced nature could not only create economic mayhem, but they could potentially create unprecedented distress in the market. One could also argue that there’s nothing “artificial” about these transformations at all. Digitization and the growing utilization of social media, cryptocurrency and other ICTs is simply creating new opportunities for businesses to form, grow and thrive. The drivers may be different than in decades past, but this could be looked at as an evolution of business rather than an artificial bolstering of those businesses.

Time will tell, and nobody has a crystal ball, however, we feel that it is important for investors, economists, and other pundits to recognize that today’s economy is vastly different than any other economy that we have experienced. Historical ways of analyzing economic growth and downturns are outdated and have become less accurate when factoring in the extensive shifts that have occurred over the past 15 years because of digitization. We must be careful not to over-rely on history when trying to benchmark what to expect out of future downturns.

People assume multifamily is an inflationary hedge because, as units roll, rents can be increased accordingly. While that’s true, it’s also an oversimplification. In reality, owners’ costs are also increasing. Owners must strike a delicate balance between increasing rents and controlling costs in order to truly maximize a portfolio’s value.

“While multifamily does have the potential to outperform in an inflationary environment, it can also really test operators in the sense that the best operators will be able to utilize local and industry knowledge and connections to control expenses, while measuring those expenses against the rent increases that may be captured in the market, all of which will allow strong operators to keep a healthy margin at their properties” – Daniel Farber, CEO at HLC Equity

In this article, we explore six tangible ways for multifamily owners to maximize the value of their portfolios as inflation rises.

- Link rent increases to changes in the CPI.

One benefit to owning multifamily properties during periods of high inflation is that units tend to turn over annually, and with each lease expiration, the rent can be renegotiated. Theoretically, this allows owners to at least keep pace with inflation.To prevent tenants’ sticker shock, leases can be re-written with a clause that stipulates further rent increases will be tied to at least any increase in the annual Consumer Price Index (CPI), the standard gauge of inflation. In recent years, CPI increases have been a modest 1-3 percent, but today, the rate of inflation is rising at a staggering 7-8 percent. These rent increases will be critical for boosting NOI and keeping pace with inevitably higher operational costs.

At the same time, owners should be sure to monitor their prices on an ongoing basis to ensure they’re in line with market rates and not falling behind their competitors. There are many software programs that owners can utilize to assist with their pricing and other revenue management strategies.

- Bid out and/or renegotiate existing vendor contracts.

All too often, an owner will default to using the vendors that either a) were inherited from the previous ownership; or b) with whom they already have a long-term, preexisting relationship. Owners who utilize this approach often lose touch with the “going rate” for those services and may have no idea that they are leaving money on the table.First, for any new contract, that contract should be bid out 2-4 separate vendors. This creates a healthy amount of competition and ensures that the owner is getting the best rate for that level of service.

Moreover, in the case of existing vendor contracts, the management team should review each contract and determine whether they could be renegotiated to secure better rates or terms given current market considerations. Owners with substantial holdings can often renegotiate better rates if allowing vendors to bid on a portfolio of properties rather than having different vendors service each individual asset.

To be sure, depending on the market, labor shortages often mean that owners have little room to negotiate beyond a certain point. Trying to squeeze a vendor too far may ultimately backfire, and may strain otherwise strong, long-term relationships. As always, owners need to use good judgment to strike a balance in this regard.

- Leverage bulk purchasing to get ahead of supply chain issues.

One of the primary causes of today’s growing inflation stems from ongoing supply chain issues. Certain goods simply cannot be produced fast enough to keep pace with demand, and as a result, prices for those goods are rising.While this has impacted all industries, the commercial real estate industry has been hit particularly hard. The cost of building supplies and materials has skyrocketed. For example, the price of lumber has increased 37% over the past two years. According to the National Association of Homebuilders, more than 90% of builders reported delays and material shortages last year.

One way for multifamily owners to mitigate the impact of these shortages is to leverage bulk purchasing opportunities. Owners can expand their inventory of difficult to obtain and/or expensive items, such as appliances, to ensure they have these on-hand as needed, whether needed for standard replacement or as part of a unit’s larger value-add overhaul.

- Consider implementing a RUBS system.

Utility income is an often overlooked source of income for multifamily owners. If a building is not already individually metered, an owner should evaluate the feasibility of doing so. This would allow the owner to shift some of that cost burden to tenants, something that becomes more valuable as utility costs rise. Submetering can be done for water, gas, and electricity.Alternatively, an owner may consider implementing what’s known as a “RUBS” system – or “ratio utility billing system”. Rather than individually metering each unit, the landlord can instead bill each unit for their “fair share” of the building’s utilities. A unit’s pro rata share if often based on the size of the unit, number of bedrooms in the unit, number of tenants occupying the unit, or some combination thereof.

Owners who utilize a RUBS system can maximize the value of this strategy further by entering into long-term, fixed-rate agreements with utility providers. Many electricity companies are still offering historically low pricing for those willing to make a long-term commitment with that provider.

- Evaluate whether some units can be better utilized as mid-term rentals.

At larger multifamily properties, there may be an opportunity to maximize revenue by converting a small portion (e.g., 5-10 percent) of units from standard, year-long rentals to mid-term rentals. Mid-term rentals will usually lease on a 3- to 6-month basis and appeal to contract workers, traveling nurses, “digital nomads,” early retirees and more.Mid-term rentals generally need to be furnished and may have higher operational costs, but on per-night basis, have the potential to generate significantly higher income. A platform like Layers can help streamline the operations associated with mid-term rentals.

- Carefully consider CapEx spending.

Although the funds may have already been set aside for capital expenditures, it is worth evaluating whether now is the right time to make those investments.

When evaluating whether and how much to invest in capital projects, be sure to consider the following: pausing value-add investments may be a double-edged sword because the cost of goods and services continues to rise. Delaying an expense today may ultimately cost more than if you were to make those investments in the future. That said, some properties may be able to pause value-add renovations if they are otherwise achieving strong, organic rent growth without making those planned improvements.In some cases, a middle-ground approach might make sense. There may be opportunities to value-engineer savings, such as replacing furniture cushions rather than replacing furniture entirely. In any event, owners will want to actively prioritize their capital spending. Discern what’s really necessary, what’s discretionary, and then determine whether some projects should be shelved until the capital environment improves.

Multifamily owners and investors are keen to remember that all real estate is cyclical. We are in an upswing right now, but how long that upswing lasts is anyone’s (albeit educated) guess. Savvy real estate owners should strive to maximize revenues and control costs—a balance that will best position them for when the next downturn inevitably occurs.

Interested in learning more about how HLC Equity maximizes the value of its investments? Watch our webinar here

On March 16, 2022, the Federal Reserve Bank announced that it would raise interest rates for the first time since December 2018. On the surface, the resulting 25 basis point hike didn’t seem like much. But the hike signals a shift in the commercial real estate landscape—one that investors are watching closely.

Rising Interest Rates – What This Really Means

First, a quick primer on interest rates: when someone refers to the Fed increasing the interest rate, this really means that the rate to borrow federal funds is increasing. In theory, this does not impact consumers directly. Instead, the target federal funds rate is the rate at which banks borrow reserve balances from one another. In practice, however, this trickles down to impact consumers.

When the federal funds rate increases, it becomes more expensive for banks to borrow the money they need to make large commercial loans. Therefore, it eventually becomes more expensive for borrowers seeking CRE loans to construct, acquire, or refinance commercial property.

As the cost of capital increases, this has ripple effects throughout the industry (which we’ll explore in more detail below).

Why Interest Rates are Rising

Historically, interest rates are correlated with inflation. For example, when the housing market collapsed in 2008 and during the subsequent recession, the federal government slashed interest rates. Doing so was an attempt to stimulate the economy. While it worked, we all know for every action there is an equal and opposite reaction. And in the case of the economy, the free flow of money into the system tends to create inflation (which impacts everyone – particularly the everyday citizen), plus the significant increase in the national debt.

Interest rates continued to hover around near-record lows until 2018 when, faced with a surging economy, the Federal Reserve began gradually increasing the rate. However, the COVID-19 pandemic put further interest rate hikes on hold over fears of another economic recession. The continued low-interest-rate environment helped to bolster the economy during a period of uncertainty.

Now, as the economy bounces back following the shutdowns brought on by the COVID-19 pandemic, the Fed is increasing rates yet again in an attempt to combat surging inflation. As of February 2022, annual inflation was up 7.9 percent—a 40-year high. See our recent article how inflationary environments impact CRE investors and owners.

The 25-basis point increase (0.025 percent) in March is just the first of what many expect to be several interest rate hikes this year. Last month, a survey of Federal Open Market Committee (FOMC) members indicated that they expected interest rates to rise another 1.875 percent by the end of 2022. They projected the federal target rate could increase to as much as 2.8 percent in 2023 before flattening out. Again, the goal is to combat inflation. FOMC members indicated that the interest rate would need to rise by this amount to stabilize inflation to closer to 2-3 percent per year.

How Rising Rates Impact CRE

Nearly all commercial real estate is purchased using some combination of debt and equity. Therefore, rising interest rates can dramatically impact the cost of real estate. In short, as the cost of capital rises, it becomes more expensive to own real estate—all else considered equal.

Let us put that in perspective. Every 25-basis point increase equates to an extra $25 per year in interest on $10,000 worth of debt. On a $10 million loan, this means an additional $25,000 per year in interest. If interest rates were to rise by 2.8 percent, this equates to an additional $280,000 per year in interest.

As you can imagine, a sharp rise in interest rates can quickly eat into an investor’s cash flow. Worse, some projects may no longer pencil out to be profitable and ultimately curb growth.

Here’s a more comprehensive look at how rising interest rates impact commercial real estate:

- Prices may come down. In recent years, CRE assets have been trading at all-time highs. It was not uncommon to see deals trading at or below a 3-cap, depending on property type and market. In a low-interest-rate environment, investors are willing to pay more for an asset. As interest rates rise, investors need to pay less for the property to achieve the same numbers. This can have a cooling effect on the market.

- Transaction activity may slow. As interest rates rise, some would-be buyers will remain on the sidelines, afraid of overpaying for a property given the high cost of debt. Meanwhile, would-be sellers may decide to hold off on selling until market conditions once again improve in their favor.

- Investors may look elsewhere. With interest rates on the rise, investors will begin looking at their alternatives. In an inflationary environment, some deals may not offer a compelling risk-adjusted return relative to other investments. For example, one consequence of rising inflation is that the yields on U.S. Treasury bonds are increasingly rising. Properties that were trading at a 3-cap become less compelling if the rate on 10-Year Treasury bonds is 2.5 percent, which they are today. In other words, the risk-adjusted returns on CRE should be higher than other investment types. If higher interest rates mean they are not, some people may decide to invest elsewhere until conditions change. The flip side of this is that the 2.5 percent “risk free rate” of a 10-Year Treasury bond does not offer any upside or future appreciation, while solid long term real estate deals operated by experienced managers can still offer upside. This is particularly the case in a high interest rate environment in which rents on multifamily assets generally benefit from inflation.

Should CRE Investors Panic? No – At Least, Not Yet.

While CRE investors should certainly monitor the interest rate environment, it is important to understand that the Federal target rate is not the be all, end all.

In fact, many would argue it’s the wrong indicator to be following. Instead, investors should be paying close attention to what’s happening to yields on 10-Year U.S. Treasuries.

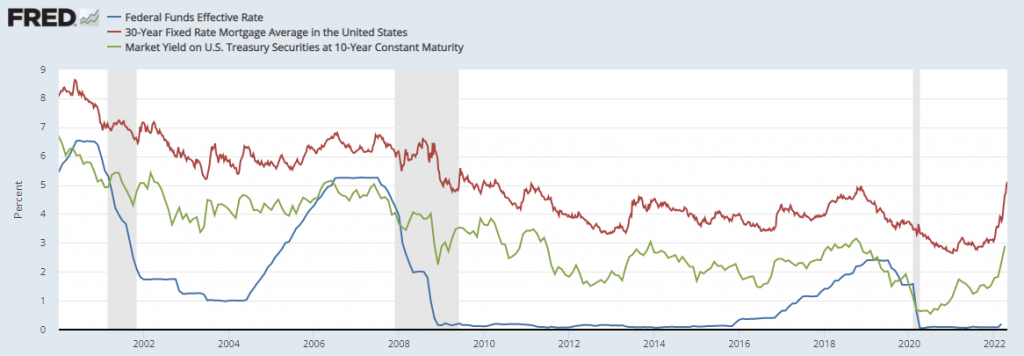

The chart below highlights how changes in the Fed’s target rate (the blue line) don’t actually have a dramatic impact on mortgages (red line). Instead, there is a stronger correlation between the yields on 10-Year Treasures (green line) and mortgages.

The yield on Treasuries is certainly influenced by the Fed’s target rate, but it is also influenced by other factors such as the stock market and geopolitical events (e.g., the war in Ukraine). Given today’s economic and political environment, it would not be a surprise to see Treasury yields increase further, therefore pushing mortgage rates up in turn.

That said, interest rates, though they are on the rise, remain dramatically lower than they were in decades past. Using the same chart above, we can see that mortgage interest rates were close to 9 percent in the early 2000s. And remember, mortgage interest rates were upwards of 18 percent in the early 1980s. We are nowhere close to that, even if interest rates “rapidly” rise.

Some sectors, such as multifamily, will continue to outperform other asset classes even amid rising interest rates. Any downward pressure caused by rising mortgage rates should be counteracted by unfettered demand for housing. Investors continue to pour record amounts of capital into multifamily and for now, this shows no signs of slowing down. Rising interest rates are generally correlated with improving economic conditions, and as the economy improves, landlords will be able to push rents to combat higher priced debt. Meanwhile, office, retail, and hospitality properties will be bolstered by a generally improving economy.

While the Fed’s interest hikes certainly draw a lot of attention, it is important to put this news in the context of other market factors driving the CRE landscape. On the whole, the CRE market remains strong. At HLC Equity, we continue to pay close attention to the debt markets as interest rates rise and act defensively to preserve our investors’ capital. Interested in learning more? Contact us today.

Inflation, generally defined as the rise in the price of goods and services, has skyrocketed over the past year. After more than a decade of gradual, 2 to 3 percent annual increases in inflation, the rate has now surged to 8.5 percent. There has been no year-over-year increase this high since the Reagan Administration.

Rising inflation impacts all facets of the economy, including commercial real estate.

As inflation rises, owners and operators of multifamily real estate will want to monitor their portfolio closely. Higher-priced commodities, rising interest rates and other factors can have a substantial impact on the profitability of an asset.

In this article, we explore six strategic considerations for multifamily owners looking to mitigate the impact of rising inflation.

- Carefully consider sales vs. acquisitions.

Typically, rising inflation is correlated with higher interest rates. An environment marked by higher interest rates is generally thought to be riskier which, in theory, could impact the value of real estate. However, not all real estate assets perform equally during inflationary times. Historically, multifamily real estate has outperformed other asset classes, especially during periods of extreme inflation. Economic growth fuels employment and higher wages, which in turn drives demand for housing. - As interest rates rise and home mortgage rates go up, owning a home becomes more expensive and therefore the own vs rent debate leans towards renting

So while rising inflation will cause some investors to retreat to the sidelines, others will want to view this as an opportunity. This will be a great time for investors to trade up into larger, higher-valued multifamily assets. Those who sell now while CRE prices are still high can utilize tools like the 1031 exchange to scale their portfolios in the months to come—investing the proceeds from that sale at a time when prices are expected to cool off a bit. The flip side of this is that real estate prices could continue to rise as they have done over the past decade, and if owners sell at higher prices with the expectation that they will defer taxes by doing a 1031 exchange into a new investment, new investments at higher yields will be harder to come by and it will likely be impossible to replace the same cashflow. - Evaluate whether some projects warrant being put on hold.

One of the reasons for skyrocketing inflation is that the costs for both raw materials and skilled labor have risen dramatically. For example, construction material costs were up 17.5 percent year-over-year between 2020 and 2021. According to the U.S. Census Bureau, that’s the largest annual increase in material costs in fifty years.Owners and operators of multifamily real estate will want to consider whether rising costs means some projects need to be put on hold. A ground-up development project, for example, may now cost more than what the owner will be able to achieve in corresponding rents given local market conditions. Similarly, an operator may decide to put a heavy value-add project on hold until the market tempers, and instead, invest in more strategic, modest property improvements in the meantime.

- Consider whether a change in unit mix can generate higher returns.

In an inflationary environment, owners will want to look for alternative ways to extract value from their multifamily investments. One way to do so is by reconsidering a property’s unit mix. For example, an owner might decide to convert underperforming 3-bedroom units into smaller 1+ bedroom units that generate more revenue on a square foot basis. Similarly, an owner may decide to repurpose 10 percent of the units as short- or mid-term rentals, a strategy that is more operationally intensive but can generate substantially higher returns. A platform like Layers can make the transition from traditional year-long leases to mid-term rentals significantly easier. - Gain spending visibility.

When faced with rising inflation, there’s no better time for multifamily owners to get a handle on all expenses. Go through all costs with a fine-toothed comb to understand where money is being spent and by whom. Analyze spending by cost category, business process, function and business unit. This ensures that all future spending decisions will be made based on their known impact to the operator’s P&L.Along these same lines, multifamily owners will want to differentiate between strategic and non-strategic spending. In an inflationary environment, some owners may be quick to cut spending in the short-term without carefully considering the ramifications that will have on the business’s long-term goals and objectives. Any cost-cutting should be done with the company’s strategic goals in mind.

- Take advantage of low-cost debt while you still can.

For nearly a decade, real estate investors have benefitted from the incredibly low-cost interest rate environment. Mortgage rates remained at historic lows during the depths of the COVID-19 pandemic, but things have started to change as we move through 2022. Mortgage interest rates have already climbed more than 100 basis points since the beginning of the year, moving from about 3.5 percent to 4.5 percent today. The Federal Reserve expects to raise short-term interest rates throughout the year, which will make the cost of debt increasingly more expensive moving forward.

Now is the time for multifamily owners and operators to consider their approach to leverage. Look at your portfolio as a whole—how highly levered are you? Are some properties more highly-levered than others? Would a rebalancing of debt be worthwhile?

For those looking to secure additional debt, now is the time to do so. While interest rates have begun to rise, they are still considerably lower than the double-digit interest rates of decades past. Owners will want to lock in low-cost, fixed-rate debt as a hedge against growing inflation moving forward.

Commercial real estate is often considered a strong hedge against inflationary pressures. This is particularly true of multifamily real estate, and especially today, as demand for housing continues to outpace supply. The housing supply/demand imbalance is expected to become more pronounced as inflation rises since rising costs will threaten the pipeline of new construction.

Of course, multifamily investments are by no means foolproof. Owners and operators will want to understand how inflation impacts their portfolios and in turn, make strategic decisions to maximize returns for investors.

Contact us today to learn more about HLC Equity’s approach to real estate investing and asset management during periods of economic disruption.

Located in a growing submarket of Dallas, HLC Equity acquires an amenity-packed community, consisting of four Class A, newly constructed buildings.

Princeton, Texas (April 19th 2022) – HLC Equity, a national real estate investment and property management firm, has announced the purchase of Southgate Apartments, a 156-unit, new construction community located in Princeton, Texas.

Southgate Apartments, the latest Class A acquisition for HLC Equity, is located adjacent to the high growth McKinney area of Dallas. The city is undergoing significant economic expansion due to growth in key industries. For the past decade, McKinney has maintained a consistent presence on the list of fastest growing cities in the nation.

The Southgate Apartments community was completed in Q1 of 2022, when HLC Equity secured the off-market opportunity from a relationship with the developer, who specializes in the local DFW market. Inheriting the lease-up component has allowed HLC Equity to generate a better yield and is expected to stabilize at a 5% cap rate. The property offers residents exclusive, never-lived-in units plus a variety of distinguished amenities. From an expansive resort-style pool and clubhouse to a state-of-the-art fitness center and a dog park, Southgate provides residents with a heightened experience, regardless of their style or preference.

“We are excited to add Southgate to our expanding Dallas portfolio. This opportunity was sourced off-market through our relationships with an experienced local developer. This community hits right in our target of acquiring high quality assets in growing markets with the high potential to outperform.” commented Daniel Farber, CEO of HLC Equity.

Southgate Apartments will be managed by HLC Equity’s internal property management team and will implement many features developed by its Layers brand. Layers endeavors to increase property value and resident experience by providing certain unit upgrade options, integrating the company’s innovative technology and offering onsite/offsite services to further benefit residents and community at large.

For more details about Southgate Apartments, visit southgateprinceton.com

About HLC Equity (www.hlcequity.com)

HLC Equity is a multigenerational company, with over 70 years of experience and an expansive real estate portfolio. Their entrepreneurial spirit of a startup is juxtaposed with institutional level execution. HLC Equity utilizes its real estate portfolio to carry out its mission of building thriving communities.

For further press inquiries or interviews please contact press@hlcequity.com

We have a very exclusive opportunity to invest in the closeout of this investment. If you’d like to hear more, please contact our Investor Relations team: ir@hlcequity.com

Interested in hearing more about HLC Equity and our investment opportunities? Sign up below

The commercial real estate industry uses a lot of lingo. For instance, one of the most popular ways to distinguish properties is by their “class” rating. Assets are typically classified as either Class A, Class B, or Class C properties. This is true across all product types, regardless of whether it’s in reference to office, multifamily, retail, or industrial real estate.

In this article, we look at the distinguishing characteristics of Class A vs. Class B vs. Class C properties. Any prospective investor will want to learn this classification system so that they understand what type of product they’re investing in when they do.

Features of Class A Properties

Although there is no universally-accepted definition of a Class A (or Class B or Class C) properties, most in the industry consider Class A buildings to be newer with higher-quality finishes, amenities and accessibility. Class A properties tend to be located in the urban core, and oftentimes have their own brand or lifestyle associated with them.

Class A properties tend to be extremely desirable, investment-grade properties with the highest quality construction and workmanship, materials, systems and amenities. They will usually have best-in-class property management, as well.

Class A properties are also distinguishable for the tenants they attract. Most Class A properties will be occupied by prestigious, highly credit-worthy tenants that are willing to pay above-average rental rates. Class A properties are frequently bought and sold by national and international investors, including institutional investors who are willing to pay a premium for quality assets.

The desirability of Class A buildings means that they provide more liquidity than Class B or Class C properties. In other words, there is enough consistent interest in Class A properties that an investor can expect to have an easier time selling the property than if they were trying to sell a Class B or Class C property in the same market.

For these reasons, Class A properties are considered one of the “safest” additions to an investor’s portfolio (but conversely, offer some of the lowest returns in exchange for this lower risk profile). They’re also among the most expensive to purchase.

Features of Class B Properties

A Class B real estate tends to offer more utilitarian space with fewer amenities than one would find in a Class A building. It will typically have ordinary design and structural features, with average interior finishes, systems, and floor plans. The systems will be in adequate condition and the property will be structurally sound, but not overwhelmingly impressive.

The maintenance, management, and tenants in a Class B property are considered good (but not necessarily great). Tenants may be less established, have lower credit, or may be unable to sign longer-term leases. Therefore, while Class B buildings tend to attract broad interest among a wide range of users, the rents these tenants are willing to pay tends to be less than what Class A properties can command.

Class B properties are often considered more of a speculative investment than their Class A counterparts. Class B properties will occasionally attract attention among national investors, but most investors tend to be local to the marketplace.

While Class B properties tend to be considered a “riskier” investment than Class A properties, there are still several benefits to adding a Class B building to your portfolio. Namely, well-located Class B properties can generally be purchased at a lower price (and therefore, have a lower barrier to entry), and can be renovated to Class A condition over time. As building improvements are made and leases turn over, the new owner can increase rents and improve the tenant mix. With thoughtful value-add strategies, an investor can realize greater returns through Class B properties than they might be able to achieve by investing in Class A buildings in the same market.

Features of Class C Properties

Class C buildings can be highly lucrative for those with a solid investment strategy, but these properties are certainly not without their risk. In fact, Class C properties are considered the riskiest of the three property classes featured here today.

One of the reasons for the additional risk is that these buildings are generally older (20+ years) and in need of substantial renovation. Many will show visible signs of deterioration, such as overgrown landscaping or crumbling building facades. These properties, because they are older, will usually include few, if any, on-site amenities.

Compounding the risk is the fact that Class C buildings tend to be located in less desirable locations. They may be farther from major employment centers and/or in areas with high crime and few neighborhood amenities. Often, those who occupy Class C buildings do so only because they are more affordable than the alternatives.

Class C properties, however, offer the potential for the highest cash flow out of these three property classes. This cash flow is hard-earned, though, given how management-intensive these buildings can be.

Primary Indicators of Property Class

There are several factors that affect a property’s classification, including location, the age of a building, property condition, amenities and occupancy. These factors should be considered generalizations, as there are almost always exceptions to each of the “rules” below.

- Location: A property’s location is one of the biggest driving factors of its classification. As noted above, Class A properties tend to be the most well-located. These properties will have easy access to major employers, hospitals, universities, and arts and cultural amenities including retail and restaurants.

Class B and Class C properties are generally in less desirable neighborhoods. Again, this is not always the case. A Class B or Class C property – whose classification is instead driven by its age, condition or lack of amenities – may have an excellent location but the building itself otherwise leaves much to be desired.

- Age of Building: Class A buildings tend to be newer (often, new construction), whereas Class B and Class C properties are usually older. Class C properties will usually be 20-30+ years old.

However, another exception to this “rule.” An older building, such as a historic property, can still earn Class A status if it meets the other criteria listed here. Older buildings are often gut renovated to include high-end finishes and other amenities akin to their newly-constructed peers.

- Property Condition: A property’s condition is one of the leading factors of its class. A property that has been fully renovated and upgraded with high-end finishes is more likely to achieve Class A status than a property that is old, weathered and in need of both cosmetic and structural repairs. As a result of property condition, Class A and B properties tend to need less maintenance than Class C buildings.

- Amenities: Class A properties will usually offer robust amenities. For example, at a multifamily property, this could mean an on-site fitness center, media room, concierge, underground or otherwise covered parking, outdoor pool, doggy daycare and more. The larger the apartment community, the more robust the amenities will tend to be. Class B and Class C properties usually have fewer, if any, amenities to offer residents.

- Occupancy: Occupancy is a key factor in property class. Class A properties tend to have high occupancy rates, whereas Class C properties will usually have disproportionately high vacancy rates (with Class B properties falling somewhere in between). The tenants who occupy Class A buildings will generally be more established, higher earning, and will boast stronger credit profiles than those who lease Class B or C properties.

People often ask whether it is “best” to invest in Class A, B or C properties. There is no right or wrong answer. Any of them can be an excellent investment opportunity depending on the terms of the deal and the investment strategy. Any investor will want to consider their own risk tolerance, need for liquidity, and portfolio diversity when considering deals among different property classes.

Many investors will refer to a project’s “equity waterfall,” which at first glance, may seem complicated or difficult to understand. In reality, the equity waterfall simply refers to the manner in which cash flow and other profits are returned to investors.

What makes waterfalls complex is that they can be structured in countless ways. Understanding the structure is important for any passive investor who is considering investing in a commercial real estate deal.

Understanding What’s Behind the Name

At first glance, the term “waterfall” might not be one you’d expect to see applied in commercial real estate. But a deeper look behind the name reveals why this term is, indeed, quite appropriate.

The term “waterfall” stems from the idea that cash flow from an investment flows to different parties in numerous ways. The profits gather in a “pool” until that pool is full, at which point the profits spill over to the next pool of investors in a tiered fashion. It’s just like when water gathers at the top of a waterfall and then, after reaching a certain threshold, spills over to a pool below, sometimes multiple times.

Just as nature’s waterfalls can have numerous pools below, so too can real estate waterfalls.

Common Equity Waterfall Terms Explained

Before getting into an example, it’s helpful to understand a few terms that are often used when discussing commercial real estate equity waterfalls. Understanding these terms will help you understand why certain tiers of a waterfall function the way they do.

- Return Hurdles: A return hurdle defines the rate of return that must be achieved before the cash flow can flow from one tier to the next. Most waterfalls have multiple return hurdles. These return hurdles are often based on an internal rate of return (IRR) or equity multiple.

- Preferred Return: The preferred return, or “pref,” refers to the return certain investors will earn before other investors (e.g., common equity investors) begin earning their returns. Depending on how an investment is structured, there may or may not be a preferred return offered.

- Lookback Provisions: When equity waterfalls distribute cash flow prior to the disposition of the asset, the deal will typically contain what’s known as a “lookback provision”. Essentially, if the limited partners don’t get their minimum agreed upon rate of return after disposition, the general partner (e.g., the sponsor) is required to give up a portion of the cash flow they collected prior to the sale. This lookback provision is one of the key ways to motivate the GP to meet – if not exceed – return projections.

- Catchup Provisions: Whereas some equity waterfalls are structured to distribute cash flow to different parties during the course of the deal, other equity waterfalls are structured with what’s known as a “catchup provision.” A catchup provision stipulates that the limited partners will receive 100% of the deal’s cash flow until an agreed upon rate of return is met. After achieving that rate of return, all proceeds will then go to the general partner until they’ve received a specified rate of return.

A Common Equity Waterfall Structure

The most basic equity waterfall typically has four tiers. As described above, the first tier is where the cash flow builds into a pool—once that pool overflows, the profits flow down to the next tier.

Tier I. Return of Capital: In this tier, 100% of cash flow distributions go straight to the LPs.

Tier II. Preferred Return: All cash flow is distributed to the LPs again until a preferred return on their investment is achieved. The preferred return is sometimes referred to as the “hurdle rate” and can range from 7-10% or more.

Tier III. Catch-Up: This is where the catch-up provision comes into play. All distributions in this tier go to the GP until they achieve a certain percentage of the profits.

Tier IV. Carried Interest: At this point, the GP receives a disproportionately larger share of the cash flow distributions in the form of promotes.

A Sample Equity Waterfall

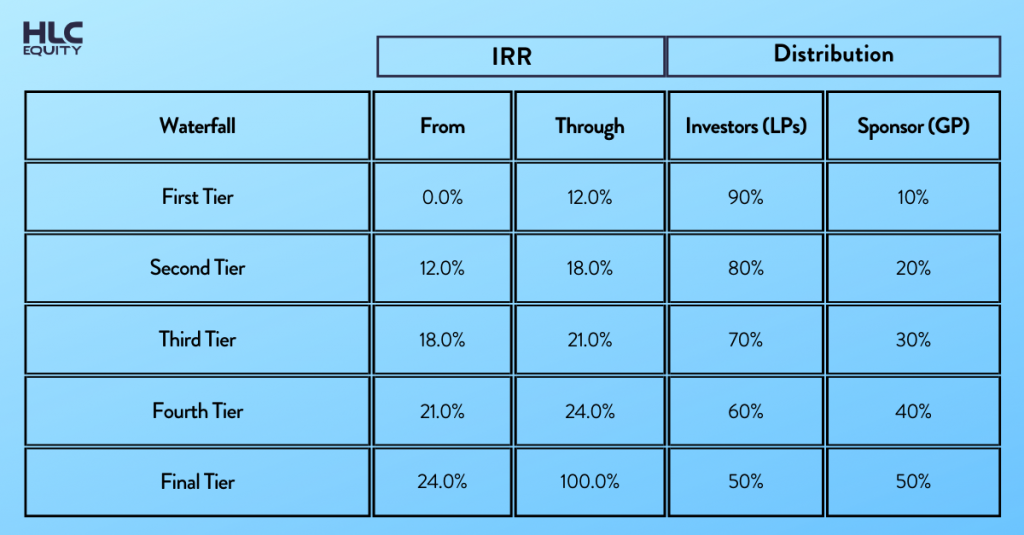

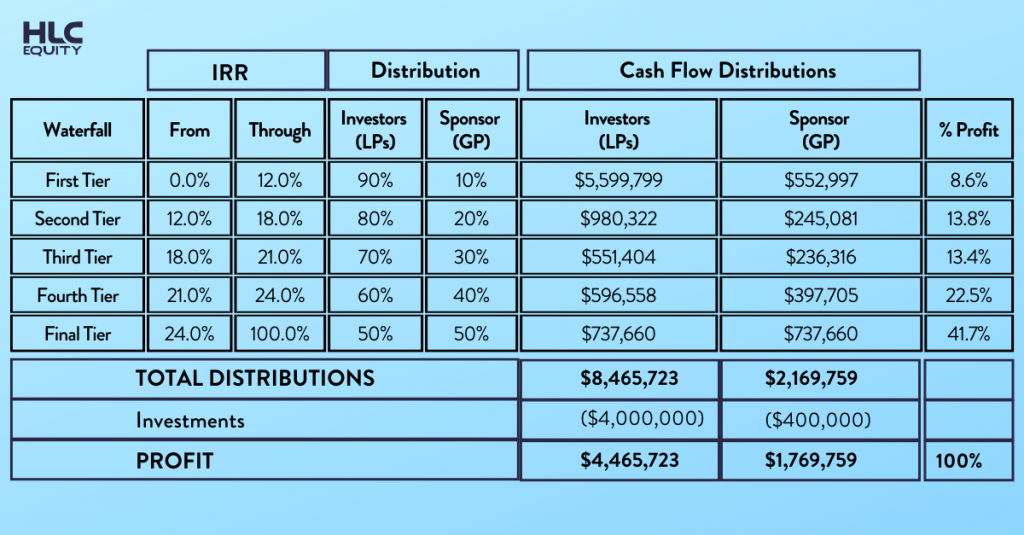

Equity waterfalls can be structured in many ways. Here is a very basic example in which the LPs have invested $4 million (90% of total equity) and the GP has invested $400,000 (10%). Here’s how a basic waterfall might be structured in this case:

And here is how that might take effect, in practice:

As you can see in this example, the LPs have more invested in the deal and therefore, earns a preferred rate of return until a certain IRR threshold is met. Once that IRR threshold is met, the GP begins to earn a disproportionately larger share of the profits in the form of “promote”. These promotes are intended to motivate the sponsor to work diligently on the investors’ behalf, essentially earning success fees if they exceed original return expectations.

Real estate equity waterfalls are not easy to grasp, even for those who have years of experience in the industry. They can be filled with complicated tiers, returns, and provisions that are all interconnected to support a structure of uneven distributions of profit from a specific project. Breaking down the different features of an equity waterfall can provide investors with a clearer understanding of how a project’s returns will be distributed to whom and when.

“Cap rate” and “IRR” are two commonly used metrics that investors use to evaluate commercial real estate investments. They are metrics that many lenders will use, too, when underwriting a deal prior to making a loan on commercial property.

In today’s article, we look at the difference between cap rates and IRR, how each is calculated, and when to use which to evaluate a multifamily deal.

What Are Cap Rates?

Simply stated, a cap rate (technically, “capitalization rate”) is a formula used to estimate the potential return an investor will make on a property. Knowing a property’s cap rate is one way for investors to compare opportunities.

The cap rate is expressed as a percentage that varies according to asset class, quality of the asset, stage of the cycle we are in, and other factors, and have an inverse relationship to property value – the higher the value, the lower the cap rate, and vice versa.

How to Calculate Cap Rates

The cap rate for a building is derived by dividing the net income (unlevered) by the price or total cost of the building.

Cap Rate = Net Operating Income (NOI) / Property Value or Cost

The net operating income (NOI) is usually the actual NOI for the property over a one-year period. The property value is typically the seller’s asking price for the property, or the purchase price the investor is expecting to pay for the property.

For example, a building with $500,000 of net income that cost $10 million to purchase will be said to have a 5% cap rate.

Cap rates can be used to calculate the value of a building. For example, if in a particular geographical area, apartment buildings of the same age and caliber are selling for 5 caps, then a building with $1 million of net operating income will be valued at $20 million.

Note, however, that debt is not part of the cap rate calculation. Cap rates assume a property is purchased without leverage. This is because the cost of debt can vary depending on the investor’s profile, experience, amount of equity in the deal, etc., and therefore, including the cost of debt could skew the numbers for those looking to make an apples-to-apples comparison from one deal to another.

What is IRR?

An internal rate of return (IRR) is another way to value an investment opportunity. The IRR attempts to express what someone will make on an investment over the duration hold period, taking into consideration potential changes in income, property value, and debt service. IRR expresses total returns on a project, though they may vary from year to year, on an annualized basis.

In short, IRR is a value that describes the sum of all future cash flows according to when they occur in time. The sooner the same earnings from an investment are received, the higher the IRR.

How is IRR Calculated?

Calculating IRR is somewhat complicated. It is an abstract topic that considers the time value of money and the rate of return the investment provides over the entire life of an investment. According to the basic time-value of money principle, a dollar received today is worth more than a dollar received in the future given inflation. The IRR is essentially a way to discount earnings received in the future. The further in the future earnings are, the less valuable they become.

Therefore, in order to determine IRR, you first need the yearly cash flows the investment property is projecting to produce or has produced. The cash flows include both: (1) cash flow from rent; and (2) proceeds from the sale of the property. You must know how much cash flow is coming from each for the IRR calculation.

The challenge with calculating IRR is that even the most sophisticated investors can struggle to forecast future cash flows and sales proceeds. As such, more conservative investors will only use actual numbers to calculate a realized IRR instead of forecasted.

A few other things to note about IRR:

- The sooner the same earnings from an investment are received, the higher the IRR.

- Therefore, a project with a higher IRR does not necessarily mean it’s a “better” investment than something else. A higher IRR could translate into the same cash flow received but at an earlier point in time. A project with a lower IRR could have better returns but those returns are generated later in time.

- IRR calculations do not take into consideration the risk profile of a project or other variables that could potentially impact overall returns.

Why is IRR Important?

IRR is an important metric in that it can be used to supplement cap rates. Unlike cap rates, which only use the first-year NOI and purchase price, the IRR calculation factors in NOI for multiple years as well as the sales proceeds, so it’s a more comprehensive look at a project’s overall returns.

IRR also allows investors to compare various investment opportunities, including but not limited to real estate deals, and allows for leveraged returns to be compared.

When to Use Cap Rates vs. IRR

There are different situations in which investors would want to use cap rates, IRR, or both.

IRR is a particularly useful tool in that it considers the term of the investment, which is valuable when looking at short to medium-term investments, or those that have a fixed period and projected exit strategy. For smaller projects, such as two and three-family home investments, knowing the cap rate might suffice. But for bigger projects, like Class A apartment buildings that have institutional investors in the deal, there is likely to be a set term upon which the investors are expecting to be repaid. In situations like these, calculating a projected IRR is essential and the only way to get to that number is by also projecting an exit cap rate – so both calculations are needed.

As noted above, any investor who wants to compare investment opportunities including the cost of capital will want to use IRR, as IRR can be calculated both with and without leverage. Cap rates never factor in debt.

The most important distinction between cap rates and IRR is that cap rates provide only a snapshot of the value of a property at a given moment in the investment lifecycle, whereas IRR provides for an overall view of the total returns on the investment on an annualized basis.

Cap rates and IRR are both useful tools for projecting the returns an investor might expect to earn. There are others. And to be sure, both of these tools have their own shortcomings. That said, looking at cap rates and calculating a property’s IRR should be a requisite step in any investor’s underwriting process.

Who makes the decisions in a family-run business? What metrics are used to evaluate the CEO? What kind of challenges do they face? Daniel N. Farber helps answer all these questions in episode 2652 with Joe Fairless by pulling back the curtain on what being a CEO for this type of investing firm is like. From what his KPIs are to who he reports to, Daniel gives the Best Ever listeners an insider look at how this multi-generational real estate investment firm is run.

Listen to it below and check out the transcript.

Joe Fairless: Best Ever listeners, how are you doing? Welcome to the Best Real Estate Investing Advice Ever Show. I’m Joe Fairless. This is the world’s longest-running daily real estate investing podcast where we only talk about the best advice ever, we don’t get into any fluffy stuff. With us today, Daniel Farber. How are you doing, Daniel?

Daniel Farber: Very good. How are you, Joe? Thanks for having me.

Joe Fairless: I’m glad to hear that, I’m well, and you’re welcome. I’m grateful that you’re on the show. A little bit about Daniel – he’s the CEO of HLC Equity. HLC Equity is a multi-generational real estate firm. They’ve owned and operated real estate in over 25 states, and they’ve owned and managed over 7 million gross square feet of commercial residential and development land. His company is based in Pittsburgh, Pennsylvania. They invest, as I mentioned, all over the US. With that being said, Daniel, do you want to give the Best Ever listeners a little bit more about your background and your current focus?

Daniel Farber: Sure, definitely, 100%. So real quick on the personal side for me… I actually never thought that I was going to go into real estate, and much less a family business. I kind of started out in my career through journalism and then going kind of the diplomatic route, eventually becoming a strategic consultant to high-tech companies and some political organizations. Through that, I kind of touched upon business and several different factors that got me much more interested in going that route. That’s kind of where one thing led to another, and I got eventually involved in real estate first and then eventually into the family business, which is where I am today.

As you said, HLC equity is a multi-generational real estate investment company. We are a company that has gone through various iterations, having been around for decades. Basically, founded by Herman Lipsitz, who was my grandfather. He was just an ambitious entrepreneur, a child of the depression, just an all-around great, hardworking guy. He had a distribution business in the morning, a law practice in the afternoon, and with the proceeds, he would buy real estate in the evening. It was at a time when it was a little bit different of a market than it is today, so I guess you could do that, even though I often think about how did he do that when a fax machine was considered innovative. But he did it.

So basically, throughout the period of time, there was everything from land and development and residential shopping centers. Eventually, as he got older, really the strong focus became more neighborhood shopping centers, and eventually, just net leased assets was really a bulk of the kind of company holding.

That went for some period of time, until eventually, as I got into the business, and some other folks got into the business, we really wanted to make a shift and we said “How are we going to grow this thing? How are we going to take what we have and to grow it?” So what we’ve done is really shifted into the multifamily space, done a lot more in the multifamily space over the last, call it, seven to eight years… And then also, while our company used to be primarily just kind of deal by deal with partners, Pari Passu, or else just on our own, we built out the infrastructure and the wherewithal to be able to be stewards of investor capital and bring in investors of all shapes and sizes. That leads us to kind of where we are today.

Joe Fairless: It’s a multi-generational real estate firm, as you mentioned, and you are the CEO. I’m curious about the structure. Who do you report to as the CEO?

Daniel Farber: You have a very good question. Part of our growth was bringing in obviously really great people. We have a committee that’s kind of our executive committee, so that’s the management, and then we have the family, and we separate the two. At the end of the day, decisions are made by the family, but with heavy weight by the executive committee.

Joe Fairless: Interesting. Okay. How many people are on the executive committee?

Daniel Farber: Five.

Joe Fairless: Five people are on the executive committee. And how many people have votes in the family?

Daniel Farber: There’s three, at the end of the day, but they’re weighted in different ways. The actual ownership is somewhat proprietary, just because it’s family, but it’s weighted in different ways. But there are really three votes all at all.

Joe Fairless: Okay. What are the responsibilities of the executive committee, those five people who are not family members?

Daniel Farber: It’s really team members that we brought in, from CFO, head of operations, head of asset management, and head of investor relations.

Joe Fairless: Okay, I’m with you. So they’re not board members, they’re active employees in the business who make up a committee. And since they are on the ground and know the business, that’s why the family takes their opinion into account.

Daniel Farber: Yeah. Not just take into account, but very seriously. I’ll give you an example. Let’s say we have some sort of building structural issue in a property in Dallas, which is typical for some properties in Dallas, as you know. Our head of operations and our head of asset management – they’re going to know much better what the situation is, and their opinions, for us, matter much more, because they’re on the ground, as you said. Much more than like if it was just important executives with fancy titles. That’s why their opinions count more when it comes to just daily operating this stuff.

Joe Fairless: What are the metrics by which you’re evaluated as CEO?

Daniel Farber: We actually use a system from the Scaling Up Program, if you’re familiar with it. Every quarter we have KPIs, and everybody on the team has KPIs, down to — everybody. Based off of it, for hitting those KPIs, that is definitely what I’m judged on. There are other factors obviously also, but that’s kind of how we really, from a numbers standpoint, keep track of it.

Break: [00:06:09] – [00:07:42]

Joe Fairless: Just to get an idea of your responsibilities, what are your KPIs for this quarter?

Daniel Farber: Annually, there’s a certain amount of acquisitions that we want to hit and there’s a certain amount of investor acquisitions that we want to create new relationships. Just as an example, one would be, per quarter, we want to do our kind of sweet spot acquisition, which is anywhere between 20 to 70 million dollar purchase price. That’s an example of, if we hit that. But then it goes to marketing and how much content we’re putting out, hence podcasts… There’s how many investors come into our portal operationally, are we hitting all of our KPIs? So on and so forth. It really touches every division.

Joe Fairless: What are your new investor goals per quarter?

Daniel Farber: Right now, we’re shooting for 40 new signups per quarter. We pretty much have hit that.

Joe Fairless: Nice, congrats. Well, no need to do any more marketing. You’re good for this quarter.

Daniel Farber: No.

Joe Fairless: [laughs] I’m kidding.

Daniel Farber: That’s the point.

Joe Fairless: I know.

Daniel Farber: I don’t know if we’re shooting too low, or the folks that are in charge of that are just doing an amazing job… But I’m happy that we hit it.

Joe Fairless: Is a sign-up someone who signs up for your portal and shows interest? Or is that someone who actually puts money in a deal of yours?

Daniel Farber: Great question. No, the 40 is that we build a relationship with them by them signing up.

Joe Fairless: So 40 new people who fund, invest money with you per quarter?

Daniel Farber: Yeah. You’re asking a really good question, because there’s a huge difference between somebody who signs up and somebody who invests. And I don’t mean it in the sense that there are so many people who can sign up and very few invest. I mean it in the sense that it’s touchpoints. So I’ve had conversations with folks, and it has led to nothing for three to four years, but then in year five, it has led to something significant, whether it’s a large investment, a large partnership, or whatever it may be. So it’s very hard to quantify that stuff. I think it’s actually maybe a little bit too transactional to say like, “Okay, you got them in. Did they invest?” Obviously, you have to have forward momentum. We talked about this a lot, because it comes down to networking also. At the end of the day, we just want to build meaningful relationships with great people that we can work with over the long term. So if they invest that quarter, or two quarters, or in five years, or not at all, that’s just a matter of [unintelligible [10:03] if you get what I’m saying.

Joe Fairless: Mm-hmm. What have you seen is your conversion rate from people who sign up to learn more to people who actually fund?

Daniel Farber: I don’t have an exact number for you, honestly. I would need to kind of dig deeper, because we actually just completed a transaction in which we saw, thankfully, a lot of traction, and that literally just closed this week.

Joe Fairless: Congrats.

Daniel Farber: Thank you very much. I think that in order to get a real solid number, I would need to get back to you on that. I don’t have the exact rate as of the last kind of quarter.

Joe Fairless: Taking a look at the people who did fund the new leads, what are the top three lead sources for those individuals?

Daniel Farber: I would say the top lead sources…

Joe Fairless: Where did they come from?

Daniel Farber: No, I got you. I’m just trying to think. So we fund these deals in different ways. We have relationships with wealth management groups that bring their clients into our deals, and those are significant checks usually. We have our own friends and family-accredited investors who bring in anywhere between 100 to 500,000. Then we have our own HLC Direct which is our direct to investor platform. Those are really our three routes. We do work with some private equity groups when it gets to the larger deals as well.

Joe Fairless: Got it. Okay, fair enough. So going back to the goal of 40 new people who are funding…

Daniel Farber: Our social media platform is not as robust as many others and it’s probably an area we should put more focus on. We definitely get a lot of traction to our newsletter. So we get people to sign up to our newsletter, a lot of times that does come from social media, but it also comes through other venues which I can discuss. Through that newsletter, frequently, we get a lot of signups onto our investor portal. We run a Global Real Estate and Technology Summit, and I can get into what that’s all about. But interestingly, the most amount of kind of signups to our newsletter comes from that.

Joe Fairless: Okay. How many people on your newsletter?

Daniel Farber: I believe we have roughly 3500.

Joe Fairless: Wow, that’s a good chunk of people. Let’s talk about this. The reason why I asked these questions is most of the listeners are active investors, and they’re looking to do similar things or are currently doing similar things.

Daniel Farber: I think it’s great questions. I don’t have all the answers because it’s stuff that we’re constantly switching. Because I don’t think that there is the magic formula. I think different groups kind of like to attract in different ways, but I’m definitely happy to discuss it.

Joe Fairless: Just for my own clarification, a couple of things. HLC Direct, you said that’s direct to investor platform. What’s the difference between that and just working directly with friends and family?

Daniel Farber: This allows us to expand. Our whole thing is we want to expand our relationships and we want it to be direct with us. The more direct we can be, I just feel, the stronger the relationship. Forget about the broker fees, or if you work with other platforms there are fees, that’s not really what I’m interested in. What I’m interested in is having direct relationships with investors. So it’s allowed us to grow that because people are either receiving our newsletter or seeing stuff on social media. They frequently like what they see and so they sign up for our platform for HLC Direct. Through that we’re able to build more relationships.

Joe Fairless: I get that. But what I’m trying to understand is you mentioned the three groups, wealth management groups, friends and family, and HLC Direct. So what’s the difference between friends and family and HLC Direct?

Daniel Farber: Friends and family are people that I would say that we have relationships with, and we’ve had relationships with for some time. The traditional friends and family route. HLC Direct is exactly what I said of the lead source. This goes back to your question, the lead source being either a newsletter, or social media, or some other form of third-party ways of getting to them. Again, we have our summit, which is helpful as well.

Joe Fairless: Got it. Okay. The Summit, Global Real Estate and Technology Summit, when’s the last time you did it and how many people attended?

Daniel Farber: First of all, it’s global because we actually don’t do it in the US. Even though we’re fully US-based, we actually host this in Israel. The last time we did it was in 2019. We were obviously in the planning stages of 2020, and then we were unable to do it. We hope to do it this coming spring or summer. The last event that we had, we keep it an international but pretty high-level event. The focus is on quality over quantity. We have 350 people, I think, the last time, we have several sponsors, we have everybody there from the family offices, VCs that are interested in investing in technology, technology companies, real estate owners, and operators. It’s really in order to build an ecosystem around this phenomenon that is now mainstream. But when we started it, it was less so of the convergence of real estate and technology.

Joe Fairless: Are you hosting it this year?

Daniel Farber: I very much hope that we will be able to. Hopefully in the beginning of June. Are you coming?

Joe Fairless: How can I and others learn more where do we go?

Daniel Farber: 100%. On hlcequity.com, under Our Brands, one of the brands is Proptech 360, that is the event. Or you can just Google Proptech 360 Israel and it’ll come up.

Joe Fairless: Nice. As CEO, you said you’ve got the acquisitions, focus, new investor focus, among other things also, what’s been the most recent challenge that you’ve had?

Daniel Farber: I think that the challenge is by far the acquisitions environment, the competition, and just finding deals. I guess we got spoiled buying deals in Denver and Dallas for seven or eight cap. The readjustment in mentality, that’s hard, and also just getting comfortable in making sure that you’re buying right because real estate is all about the buy. That’s very challenging to be confident in today.

Joe Fairless: Taking a step back, what’s your best real estate investing advice ever?

Daniel Farber: I think I just said it, the buy really matters. Because from there, you have so much room if you can buy right. I really do think that that is great. The next one is just buy stuff that you can hold for a long time. Because I’ve seen, over the decades, if you’re able to buy right, and then you’re able to hold, you can do well. It appreciates, you can depreciate, you can refinance, you can do lots of great stuff, and it really is powerful.

Joe Fairless: Let’s pretend tomorrow, you’ve got a closing, would you rather be buying a 300 unit or selling it tomorrow?

Daniel Farber: I would rather be buying it.

Joe Fairless: Why?

Daniel Farber: Because I’m sure, similar to you, every single day I have people knocking on our door saying we have this great off-market offer, we’re going to offer you a premium, and so on and so forth. Then the question is, right away, what are we going to buy? I think that in my opinion, again, we just bought a brand new 330-unit deal and we have other deals under contract. Obviously, it’s a great seller’s market but at the same time, if you’re thinking long term, which is what we always try to do, at the end of the day, holding hard assets right now, I think, is going to be beneficial.

Joe Fairless: What deal have you made the most amount of money on?

Daniel Farber: You know, it’s funny. The deals that we make the most amount of money on are deals that we do on our own, and there are what I call quirky deals. We don’t do them with investors because it’s more risk than we’re willing to take on responsibility for investor capital unless they’re highly sophisticated and are willing to basically lose it all. We do the best on deals where we don’t care about the cap rate. But we know there’s some sort of intrinsic short-term value that distorts what the cap rate is. We’ve done deals in Brooklyn, New York where we bought smaller multifamily buildings for, call it a going in of one and a half to two cap. But we were able to add value in specific ways on that deal, we kind of knew it going in, and we went around and sold it for great returns a year or a year and a half after that.

Joe Fairless: What was the value-add play there?

Daniel Farber: With that specific deal, we knew that we could buy certain stabilized tenants, we knew that there were renovations that we could make. This was going back in 2012, we could see that the market there was just becoming super hot. So a mixture of our tenant buyouts that we were able to do our renovations, and then the market taking off was helpful in that. But again, like going in, it’s not a sure thing. It’s very nerve-racking buying in a low cap like that. We did something very similar, and this wasn’t multifamily. But we did something very similar right around April, as COVID is hitting. We’re contacted by a broker to buy an occupied Veterans Association Clinic. Here on the deal was there was one year left, the upside was it was a development deal, and assuming that the VA left, there was development rights to build 80 to 90 units. We looked at the deal and we said, “Okay. The VA, they’re paying way less than they should. If we want to, we can develop it even though we’re not developers. We could partner with a developer and build a bunch of multifamily units in this prime neighborhood.” But going in, again, we were paying a two cap. In the end, we ended up being able to work out a deal with the VA, which was my preferred route because it was safer. We got a brand new 10-year lease with the government, around three times higher than what our original rent was. We were able to over double our money within a year, and then not sell, and finance it, and just enjoy. Those types of deals are the deals that we do the best on financially, but that’s not where our focus is in terms of growing our business.

Joe Fairless: On the flip side, how much have you lost as far as the most money you’ve lost on one deal?

Daniel Farber: For me personally, since I’ve been heavily involved in the business, on our new acquisitions, there have not been any. I don’t say that because I think they were amazing, just that we’re lucky because it can happen. Definitely, with the firm, especially in the shopping center business which is a whole other animal, there have been occasions where let’s say a major tenant leaves and that causes a huge financial hit. The exact largest one I can’t point to, but it definitely has happened. Frankly, if it’s a group that’s been around for a long time, then they should have some sort of losses, or else they haven’t been doing enough real estate.

Joe Fairless: We’re doing a lightning round. Are you ready for the Best Ever lightning round?

Daniel Farber: I hope so.

Joe Fairless: I know you are. Alright, first a quick word for our Best Ever partners.

Break: [00:20:34] – [00:23:22]

Joe Fairless: What is the Best Ever way you like to give back to the community?

Daniel Farber: Because I’m so involved in real estate in a built environment, I’m involved with an organization that’s very similar to Habitat for Humanity. I just really think that that’s something that speaks to me because we’re able to provide decent housing to people who really need it.

Joe Fairless: How can the Best Ever listeners learn more about what you’re doing?

Daniel Farber: I think the best way is either to connect with me on social media, which I’m always happy to connect with new people. Or to sign up for our newsletter and you’ll be able to see all of the activities that we’re doing. We don’t necessarily publish everything out on social media but we do put a lot more in our newsletter. You can do that by going to hlcequity.com, and just to connect, and you can see how to subscribe to our newsletter.

Joe Fairless: Your website will also be in the show notes for everyone. Daniel, thank you so much for being on the show and sharing…

Daniel Farber: I really appreciate it. This was great. Thanks for everything you do for the industry.

Joe Fairless: Yeah. Interviews like this are helpful for everybody involved. You gave some insightful information about your business and I sincerely appreciate that. I hope you have a Best Ever day and we’ll talk to you again soon.

Daniel Farber: Great, thanks a lot.

Commercial real estate, once considered an alternative asset class, is starting to enter the mainstream. Investors, large and small alike, are starting to recognize the many benefits of adding real estate to their portfolios.

That said, even the most sophisticated investors are sometimes at a loss with how to begin investing in commercial real estate. Some of the best, most lucrative deals are only accessible to the upper echelon, including institutional investors and large private equity firms.

Given the high barrier to entry, several retail investors have begun participating in real estate syndications. With this type of investing, a sponsor identifies a specific opportunity and then pools capital from multiple people to invest as the equity in the deal. The sponsor then oversees the deal on behalf of investors, who are otherwise passive limited partners.

Read on to learn more about real estate syndication.

What is Real Estate Syndication?

Real estate syndications are a way of pooling capital from various individuals to then, collectively, invest in a real estate asset.