Our Story

A Family Story

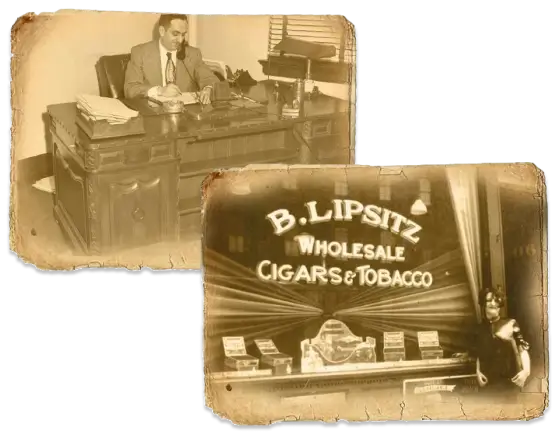

Immigrating to the US in 1906, Benjamin Lipsitz set up his peddler business in Pittsburgh PA with the purchase of a horse named Charlie. That business eventually became B Lipsitz Company, a wholesale distribution enterprise. Benjamin’s son, Herman Lipsitz was born in 1909 in Pittsburgh PA. Living in the depression of the 1930’s gave Herman an extraordinary work ethic which stuck with him until he passed away in 2005.

At an early age, Herman and his siblings worked with their father, Benjamin Lipsitz, in founding B. Lipsitz Company, which eventually became one of Pennsylvania’s largest wholesale distribution businesses. Herman started his Bachelors in Accounting at the age of 16, and subsequently attained his law degree from the University of Pittsburgh. Upon graduation from law school, Herman stayed involved with the family distribution business, while building up a successful private law practice of his own.

Our Roots

Benjamin Lipsitz

Herman Lipsitz

1909-2005

Robert Lipsitz

1949-1996

After establishing his law practice and expanding the family distribution business, Herman began buying and developing properties throughout the USA. Herman’s real estate investment interests ranged from raw land investment to neighborhood strip centers to multi-family properties, and single tenant commercial properties.

In 1941 Herman married Dr. Helen Nobel, a family physician. In Herman’s free time, he was a community leader under which capacity he involved himself in everything from serving as a key philanthropist in Pittsburgh’s greater metro area, petitioning Congress on matters of importance for the overall population and serving Thanksgiving meals at a local soup kitchen.

Herman never had an idle moment. At the age of 95, Herman went to the office every day; balancing his time between his business and philanthropic interests and spending time with his wife, children, grandchildren and great grandchildren

In every way, Herman had the support and encouragement of his devoted wife, Helen, for 63 years.