Many investors will refer to a project’s “equity waterfall,” which at first glance, may seem complicated or difficult to understand. In reality, the equity waterfall simply refers to the manner in which cash flow and other profits are returned to investors.

What makes waterfalls complex is that they can be structured in countless ways. Understanding the structure is important for any passive investor who is considering investing in a commercial real estate deal.

Understanding What’s Behind the Name

At first glance, the term “waterfall” might not be one you’d expect to see applied in commercial real estate. But a deeper look behind the name reveals why this term is, indeed, quite appropriate.

The term “waterfall” stems from the idea that cash flow from an investment flows to different parties in numerous ways. The profits gather in a “pool” until that pool is full, at which point the profits spill over to the next pool of investors in a tiered fashion. It’s just like when water gathers at the top of a waterfall and then, after reaching a certain threshold, spills over to a pool below, sometimes multiple times.

Just as nature’s waterfalls can have numerous pools below, so too can real estate waterfalls.

Common Equity Waterfall Terms Explained

Before getting into an example, it’s helpful to understand a few terms that are often used when discussing commercial real estate equity waterfalls. Understanding these terms will help you understand why certain tiers of a waterfall function the way they do.

- Return Hurdles: A return hurdle defines the rate of return that must be achieved before the cash flow can flow from one tier to the next. Most waterfalls have multiple return hurdles. These return hurdles are often based on an internal rate of return (IRR) or equity multiple.

- Preferred Return: The preferred return, or “pref,” refers to the return certain investors will earn before other investors (e.g., common equity investors) begin earning their returns. Depending on how an investment is structured, there may or may not be a preferred return offered.

- Lookback Provisions: When equity waterfalls distribute cash flow prior to the disposition of the asset, the deal will typically contain what’s known as a “lookback provision”. Essentially, if the limited partners don’t get their minimum agreed upon rate of return after disposition, the general partner (e.g., the sponsor) is required to give up a portion of the cash flow they collected prior to the sale. This lookback provision is one of the key ways to motivate the GP to meet – if not exceed – return projections.

- Catchup Provisions: Whereas some equity waterfalls are structured to distribute cash flow to different parties during the course of the deal, other equity waterfalls are structured with what’s known as a “catchup provision.” A catchup provision stipulates that the limited partners will receive 100% of the deal’s cash flow until an agreed upon rate of return is met. After achieving that rate of return, all proceeds will then go to the general partner until they’ve received a specified rate of return.

A Common Equity Waterfall Structure

The most basic equity waterfall typically has four tiers. As described above, the first tier is where the cash flow builds into a pool—once that pool overflows, the profits flow down to the next tier.

Tier I. Return of Capital: In this tier, 100% of cash flow distributions go straight to the LPs.

Tier II. Preferred Return: All cash flow is distributed to the LPs again until a preferred return on their investment is achieved. The preferred return is sometimes referred to as the “hurdle rate” and can range from 7-10% or more.

Tier III. Catch-Up: This is where the catch-up provision comes into play. All distributions in this tier go to the GP until they achieve a certain percentage of the profits.

Tier IV. Carried Interest: At this point, the GP receives a disproportionately larger share of the cash flow distributions in the form of promotes.

A Sample Equity Waterfall

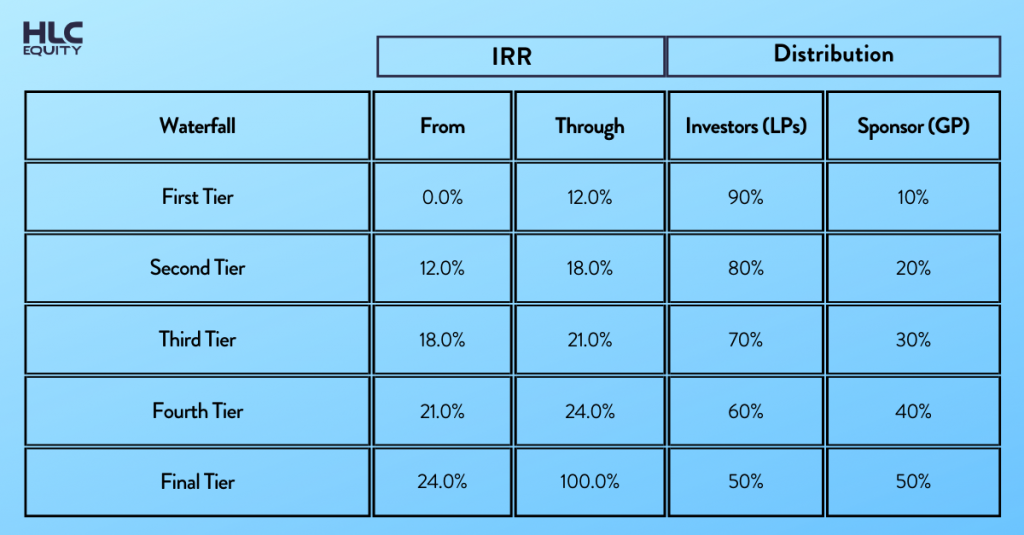

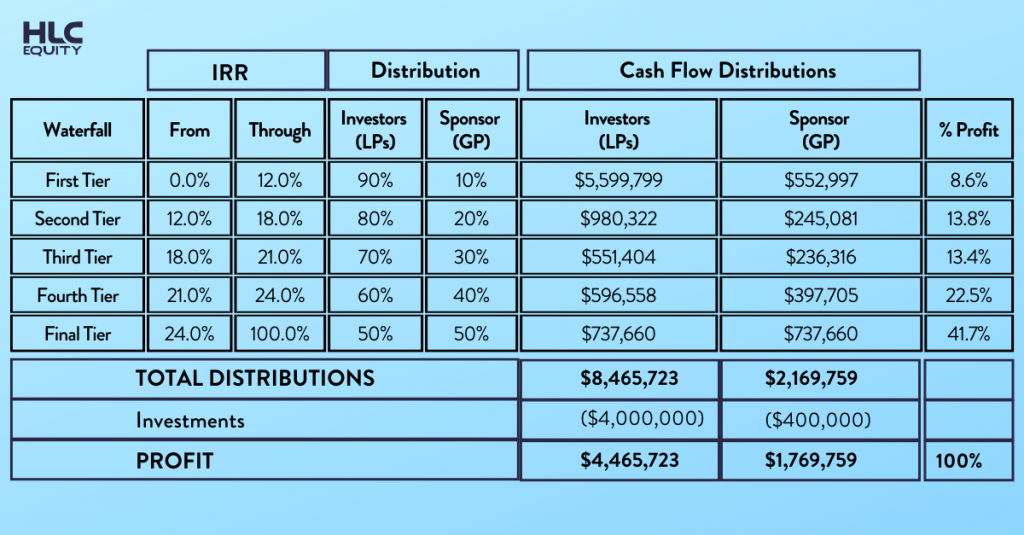

Equity waterfalls can be structured in many ways. Here is a very basic example in which the LPs have invested $4 million (90% of total equity) and the GP has invested $400,000 (10%). Here’s how a basic waterfall might be structured in this case:

And here is how that might take effect, in practice:

As you can see in this example, the LPs have more invested in the deal and therefore, earns a preferred rate of return until a certain IRR threshold is met. Once that IRR threshold is met, the GP begins to earn a disproportionately larger share of the profits in the form of “promote”. These promotes are intended to motivate the sponsor to work diligently on the investors’ behalf, essentially earning success fees if they exceed original return expectations.

Real estate equity waterfalls are not easy to grasp, even for those who have years of experience in the industry. They can be filled with complicated tiers, returns, and provisions that are all interconnected to support a structure of uneven distributions of profit from a specific project. Breaking down the different features of an equity waterfall can provide investors with a clearer understanding of how a project’s returns will be distributed to whom and when.